Discovering The Marubozu Candle

Marubozu is a single candlestick pattern that is formed by just one candle. Marubozu candlesticks gives a very strong signal and can be an excellent addition to a systematic trading system that uses other techniques.

Marubozu is a Japanese word that means "Dominance". It indicates either the bulls or the bears were dominating the financial market. Marubozu can be Bullish or Bearish.

In this article, we are going to discuss all the basics concept of Marubozu because using them properly will give you a leg up in the market. The first thing we want to cover with you is what Marubozu actually is.

In simple words, A candle with a long real body and very little in the way of the shadow or wick is called 'Marubozu'.

Marubozu Candle Anatomy

Characteristics of a Marubozu candle

| Feature | Character |

|---|---|

| Formation | The pattern consists of a single candle. |

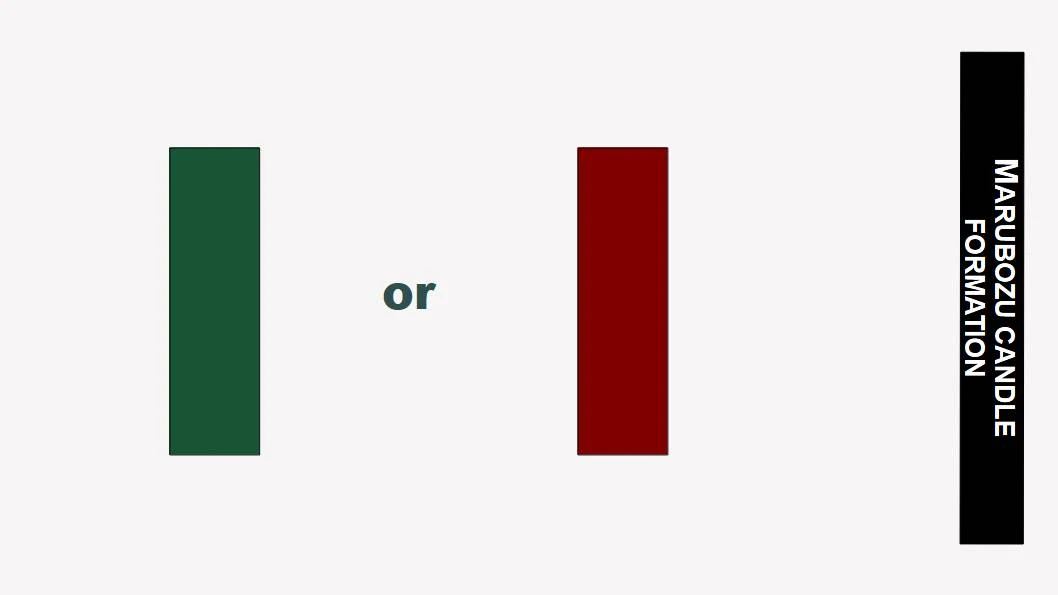

| Color | A Marubozu can be green (bullish) or red (bearish). |

| Real Body Position | The real body takes up the whole candle without any shadows. |

| Shadow | There are no shadows (wicks) at the top or bottom. |

| Shadow Proportion | Since there are no shadows, this point does not apply. |

| Range | The range is equal to the difference between the highest and lowest prices during the trading session. |

| Volatility | High volatility is present, showing strong price movement. |

| Trend | A green Marubozu usually appears in an uptrend, while a red one appears in a downtrend. |

| Momentum | The momentum is strong, indicating a clear buying (green) or selling (red) force. |

| Symmetry | The candle is symmetrical with a large real body and no shadows. |

| Volume | High volume often supports the Marubozu, showing strong interest from traders. |

The below figure, representing the three different Marubozu Candles. The candle 1 i.e red candle has no wick, the candle 2 i.e green candle has a very little wicks and the candle 3 i.e red candle has only small upper wick. Here all the candles are a valid Marubozu.

Note: Finding a perfect Marubozu Candle (with no wick) is quite difficult. So if there is a little wick available then you may consider it as a vaild Marubozu Candle.

Characteristics of Marubozu

- Marubozu can be Green or Red.

- Wide real body.

- A large real body indicates huge volatility during the session.

- No shadow or very small shadow present.

- A Marubozu candle lacks either an upper shadow or a lower shadow (On rare conditions it can lack both shadows).

- The trading range is wide. A wide range shows the increase in volatility.

- Green Marubozu signals extreme conviction among buyers.

- Red Marubozu signals extreme conviction among sellers.

- Green-Bullish Marubozu have open=low and close=high.

- Red-Bearish Marubozu have open=high and close=low.

Types Of Marubozu

There are two types of Marubozu—

- Bullish Marubozu

- Bearish Marubozu

Bearish vs Bullish Marubozu

Conditions For Bullish Marubozu

We need the following three conditions for Bullish Marubozu—

- The close must be greater than the opening price.

- The high must equal the closing price.

- The low must equal the opening price.

Conditions For Bearish Marubozu

We need the following three conditions for Bearish Marubozu—

- The close must be lower than the opening price.

- The high must equal the closing price.

- The low must equal the opening price.

Interpreting Marubozu candlestick formation

-

When the high price is equal to the open price and the low price is equal to the close price then a Bearish Marubozu is formed.

This shows that the sellers are in control of the market. It is expected that bearishness may continue over the next few trading session(volume should be large).

-

When the high is equal to the close price and the low of a candle is equal to the open price the Bullish Marubozu is formed.

This shows that the buyers are dominating the market and is expected that bullishness may continue over the next few trading session(volume should be large).

How To Use Marubozu?

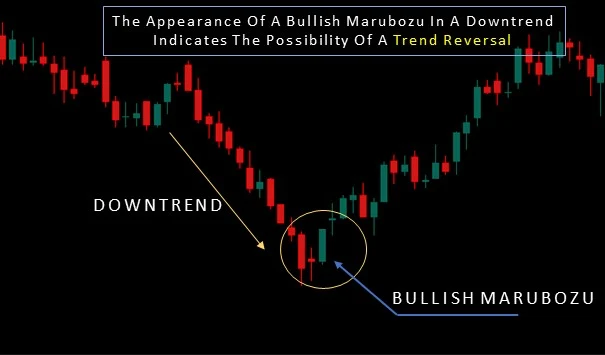

Marubozu candlestick pattern is a strong sign of trend reversal or trend continuation depending on its position on the chart.

There are four possible cases on the basis of the Marubozu candle's position.

Case 1— Bullish Marubozu in an uptrend

Case 2— Bullish Marubozu in a downtrend

Case 3— Bearish Marubozu in an uptrend

Case 4— Bearish Marubozu in a downtrend

With high volume, Marubozu becomes more powerful. Check out the volume on the day it has been formed. It's significantly higher than other days which is a positive sign.

Before entering a trade based on Marubozu candle it is very important to check other factors(Don't expose your money to others blindly).

It is effective not to trade extremely small or long candles, it could be a false setup.

In real marketplace conditions, a perfect Marubozu is pretty uncommon. For bullish Marubozu Open = Low, and High = Close. The price variation is not much when measured in terms of percent.

For example, The OHLC data for a candle is : Open = 771.8, High = 830.3, Low = 770.1, Close = 828.4

The variation between High and Close is 1.9, which is 0.22% to High. So when you trade based on Marubozu, be flexible

Formula used :

For bull - (High – Close)/Close

For bear - (Close – low)/Close

Keypoints-

- Marubozu is easier to identify due to its wide range.

- Strengthen our trading plan as a trend reversal or continuation.

- Marubozu is factual and emotive as well.

- By looking at Marubozu's candlestick, it is easy to say whether a period was bullish or bearish Marubozu (by the color).

Limitations of the Marubozu Candle

- False Signal: In volatile markets, a Marubozu candle can lead to incorrect trade entries if the trend reverses unexpectedly.

- Dependence on Confirmation: This candle type often requires confirmation from subsequent candles or indicators to validate the trend direction.

- Movement: Marubozu candles primarily indicate strong short-term momentum, which may not always translate to long-term trends.

- Market View: The overall market context and structure can significantly influence the reliability of the Marubozu candle.

- Limited Use in Consolidation: Less effective in sideways or consolidating markets, where clear trends are absent.

- Asset Variation: The success rate of Marubozu patterns can differ across various financial instruments.

- Point of View: Interpretation of Marubozu candles can vary among traders, leading to inconsistent strategies.

- Volume Factor: Low trading volume can diminish the validity of the pattern, making volume analysis crucial.