10-Year Investment Analysis: American Electric Power Company, Inc. ROI, CAGR, and Dividend Earned

Company Profile

American Electric Power Company, Inc. (AEP)

5.18

Utilities

Utilities- Regulated Electric

NASDAQ

https://www.aep.com/

21.17

0.059T (Large-Cap)

Investment Scenario

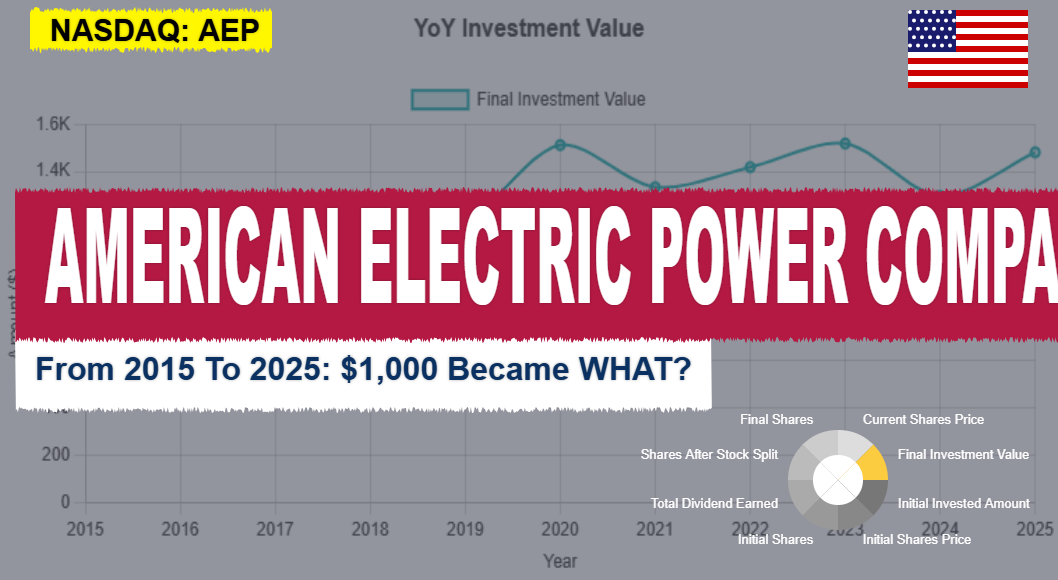

Let’s go back to 2015. Imagine an investor who invested $1,000.00 in American Electric Power Company, Inc. (AEP) company stock and held it steadily for 10 years . Instead of chasing short-term gains, the investor adopted a long-term approach—holding the shares without selling. Over time, the value of the investment grew not only through stock price appreciation but also through the accumulation of dividend payouts.

As of January 1, 2025, the $1,000.00 investment in NASDAQ:AEP would be worth approximately $1,481.12 , thanks to stock splits, price appreciation, and consistent dividend payouts. This reflects a total Gain from stocks of 481.12 , a return on investment (ROI) of 48.11%, and an annualized compounded growth rate (CAGR) of around 4.01%. This highlights the power of long-term investing and shows how a disciplined, patient approach—paired with investing in a fundamentally strong company like American Electric Power Company, Inc. (AEP)—can lead to significant wealth creation over time.

Time Period: 1 Jan, 2015 - 1 Jan, 2025

$1,000.00 invested in American Electric Power Company, Inc. in 2015 grew to $1,481.12 by 1 Jan, 2025.

Wealth grew over time through a mix of dividend income and stock price appreciation. Dividends added to capital, while stock splits increased the number of shares held. Even without reinvesting dividends, the portfolio expanded steadily. As years passed, compounding took effect — turning small gains into larger ones. Holding the stock long-term allowed capital to grow naturally. This shows how patience, steady returns, and the power of compounding can help build lasting wealth from a single investment.

American Electric Power Company, Inc. Investment Summary (2015–2025)

| Investment Duration | 10 years |

| Initial Investment in 2015 | $1,000.00 |

| Share Price in 2015 | $60.88 |

| Total Shares Purchased | 16 |

By 2025, the share price increased to $92.57. This resulted in a significant appreciation in the value of the investment.

| Share Price in 2025 | $92.57 |

| Value of 16 Shares in 2025 | $1,481.12 [1.48K] |

| Final Investment Value (2025) | $1,481.12 |

| Total Dividend Earned | $448.00 |

| Total Gain | $481.12 |

| Return on Investment (ROI) | 48.11% |

This performance reflects a Compound Annual Growth Rate (CAGR) of approximately 4.01% — a strong return over the period.

Yearly Breakdown

2015

| Shares | 16 |

| Current Year Dividend | $34.40 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $60.88 |

| Final Investment Value | $974.08 [ ~974.08 ] |

Dividend: $0.53 per share on Feb 06, 2015

Dividend: $0.53 per share on May 06, 2015

Dividend: $0.53 per share on Aug 06, 2015

Dividend: $0.56 per share on Nov 06, 2015

2016

| Shares | 16 |

| Current Year Dividend | $36.32 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $57.82 |

| Final Investment Value | $925.12 [ ~925.12 ] |

Dividend: $0.56 per share on Feb 08, 2016

Dividend: $0.56 per share on May 06, 2016

Dividend: $0.56 per share on Aug 08, 2016

Dividend: $0.59 per share on Nov 08, 2016

2017

| Shares | 16 |

| Current Year Dividend | $38.24 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $63.01 |

| Final Investment Value | $1,008.16 [ ~1.01K ] |

Dividend: $0.59 per share on Feb 08, 2017

Dividend: $0.59 per share on May 08, 2017

Dividend: $0.59 per share on Aug 08, 2017

Dividend: $0.62 per share on Nov 09, 2017

2018

| Shares | 16 |

| Current Year Dividend | $40.48 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $73.18 |

| Final Investment Value | $1,170.88 [ ~1.17K ] |

Dividend: $0.62 per share on Feb 08, 2018

Dividend: $0.62 per share on May 09, 2018

Dividend: $0.62 per share on Aug 09, 2018

Dividend: $0.67 per share on Nov 08, 2018

2019

| Shares | 16 |

| Current Year Dividend | $43.36 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $74.61 |

| Final Investment Value | $1,193.76 [ ~1.19K ] |

Dividend: $0.67 per share on Feb 07, 2019

Dividend: $0.67 per share on May 09, 2019

Dividend: $0.67 per share on Aug 08, 2019

Dividend: $0.70 per share on Nov 07, 2019

2020

| Shares | 16 |

| Current Year Dividend | $45.44 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $94.50 |

| Final Investment Value | $1,512.00 [ ~1.51K ] |

Dividend: $0.70 per share on Feb 07, 2020

Dividend: $0.70 per share on May 07, 2020

Dividend: $0.70 per share on Aug 07, 2020

Dividend: $0.74 per share on Nov 09, 2020

2021

| Shares | 16 |

| Current Year Dividend | $48.00 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $83.33 |

| Final Investment Value | $1,333.28 [ ~1.33K ] |

Dividend: $0.74 per share on Feb 09, 2021

Dividend: $0.74 per share on May 07, 2021

Dividend: $0.74 per share on Aug 09, 2021

Dividend: $0.78 per share on Nov 09, 2021

2022

| Shares | 16 |

| Current Year Dividend | $50.72 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $88.63 |

| Final Investment Value | $1,418.08 [ ~1.42K ] |

Dividend: $0.78 per share on Feb 09, 2022

Dividend: $0.78 per share on May 09, 2022

Dividend: $0.78 per share on Aug 09, 2022

Dividend: $0.83 per share on Nov 09, 2022

2023

| Shares | 16 |

| Current Year Dividend | $53.92 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $94.90 |

| Final Investment Value | $1,518.40 [ ~1.52K ] |

Dividend: $0.83 per share on Feb 09, 2023

Dividend: $0.83 per share on May 09, 2023

Dividend: $0.83 per share on Aug 09, 2023

Dividend: $0.88 per share on Nov 09, 2023

2024

| Shares | 16 |

| Current Year Dividend | $57.12 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $81.00 |

| Final Investment Value | $1,296.00 [ ~1.30K ] |

Dividend: $0.88 per share on Feb 08, 2024

Dividend: $0.88 per share on May 09, 2024

Dividend: $0.88 per share on Aug 09, 2024

Dividend: $0.93 per share on Nov 08, 2024

2025

| Shares | 16 |

| Current Year Dividend | $0.00 |

| Shares After Stock Split | No split |

| Final Shares | 16 Shares |

| Share Price | $92.57 |

| Final Investment Value | $1,481.12 [ ~1.48K ] |

No Event of stock split or dividend

Insights from the Market

AEP has traded between a 52-week low of 108.75 and a high of 109.79 per share so far this year.

Investors who bought $1,000.00 worth of AEP shares 10 years ago would now be looking at an investment valued at approximately $481.12 (as of 1 January 2025), based on the share price alone — with total returns rising to $1,929.12 when including $448.00 in dividends received over the period.